The Middle East & North Africa (MENA) are experiencing rapid Bitcoin and centralised digital asset growth, with significant statistics highlighting a region in transformation:

Transaction Volume

• Total market value: Estimated $338.7B in 2023-2024.

• Daily active traders: 500,000 (166% YoY growth).

• Institutional transactions (>$10k): Account for 93% of total volume, reflecting increased interest from larger players.

Country Leaders

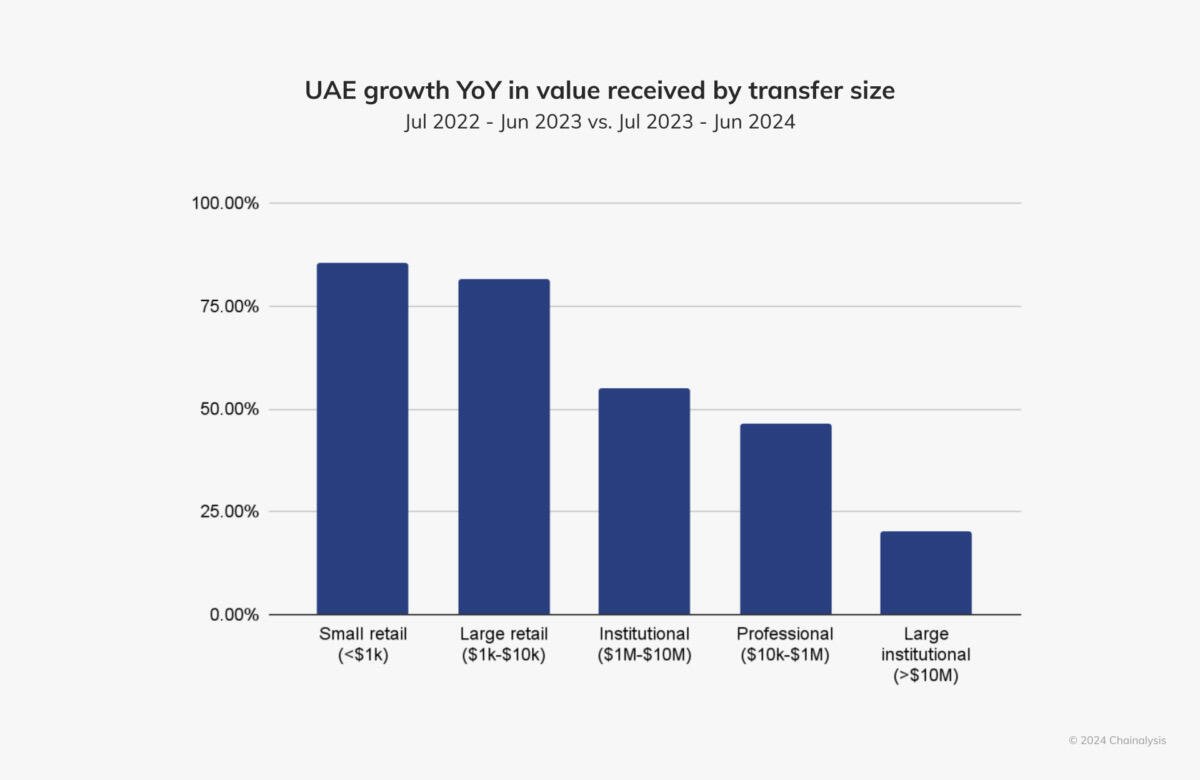

UAE 🇦🇪

• $30B+ in Bitcoin and centralised digital asset transactions.

• 72% of active users invest in Bitcoin, underscoring strong regional interest in Bitcoin specifically.

• 87% growth in decentralized exchange volume, rising from $6B to $11.3B. The UAE’s regulatory clarity and supportive framework have made it a leader in the region.

#SaudiArabia 🇸🇦

• 154% YoY growth, the highest in MENA.

• 30.9% of activity on DEXs, showing a trend toward decentralized finance.

• Regulatory Landscape: Saudi Arabia lacks the regulatory clarity established by the UAE, creating a more cautious environment for digital asset firms.

• Demographics: A young population, with 63% under 30, is driving adoption.

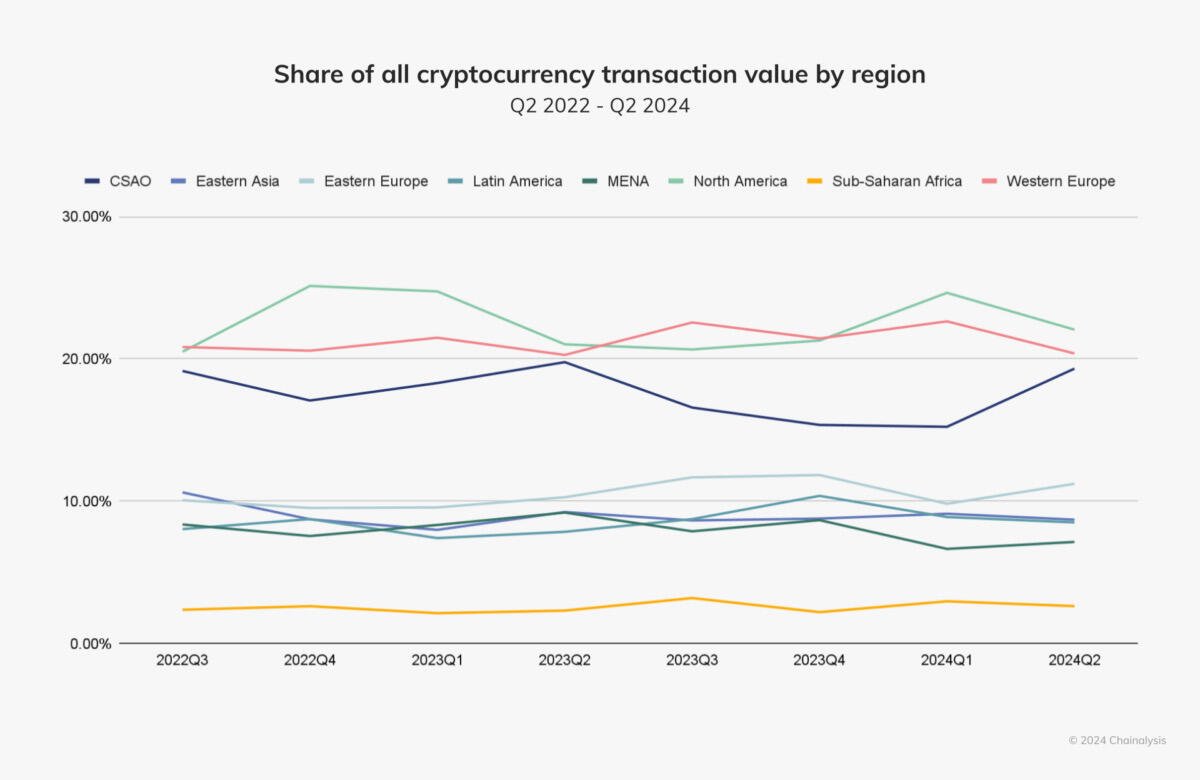

Regional Dominance

• MENA ranks 7th globally in digital asset adoption.

• #Stablecoins represent approximately 65% of transactions, highlighting demand for stable, fiat-pegged digital assets.

• Projected growth: Expected to reach 700,000 daily active users by the end of 2024.

🔑 Key Insight: This region isn’t just adopting digital assets – it’s setting up a new financial landscape. With institutional-grade infrastructure and supportive regulations in places like the #UAE, #MENA is positioning itself as a global financial innovation hub.

#Bitcoin #Nostr

The Middle East & North Africa (MENA)…