🔔Warren #Buffett’s unprecedented $325.2 billion cash reserve isn’t merely a defensive maneuver—it’s a glaring signal of looming financial instability.

The Brewing Storm

Global economic growth is projected to stagnate at 3.2% in 2024, marking the weakest five-year performance in three decades. Simultaneously, the S&P 500 has surged by 20% this year, creating a perilous disconnect between soaring market valuations and deteriorating economic fundamentals.

Following the Money Trail

Buffett’s recent strategic moves are telling:

• Liquidated over $10 billion in Bank of America holdings.

• Significantly reduced Berkshire’s Apple stake, cutting it to $69.9 billion.

• Halted Berkshire’s share buyback program for the first time since 2018.

• Shifted heavily into 5% yielding Treasury bills, amassing a record cash reserve.

The Hidden Signals

The International Monetary Fund’s latest data reveals a troubling pattern: advanced economies are expected to grow at a modest 1.7%, while emerging markets are slowing from 4.3% to 4.2%. Core inflation remains stubborn, particularly in services, indicating that the Federal Reserve’s battle against inflation is far from over.

The Stark Reality

JPMorgan forecasts a mere 0.7% U.S. GDP growth for 2024, a sharp decline from 2.8% in 2023. This aligns with Buffett’s defensive positioning—the largest cash reserve in Berkshire’s history suggests he anticipates significant market risks ahead.

The message is clear: when the world’s most successful investor hoards cash and sells flagship holdings, it’s time to pay attention. The data points to a market reckoning, and Buffett is battening down the hatches before the storm hits.

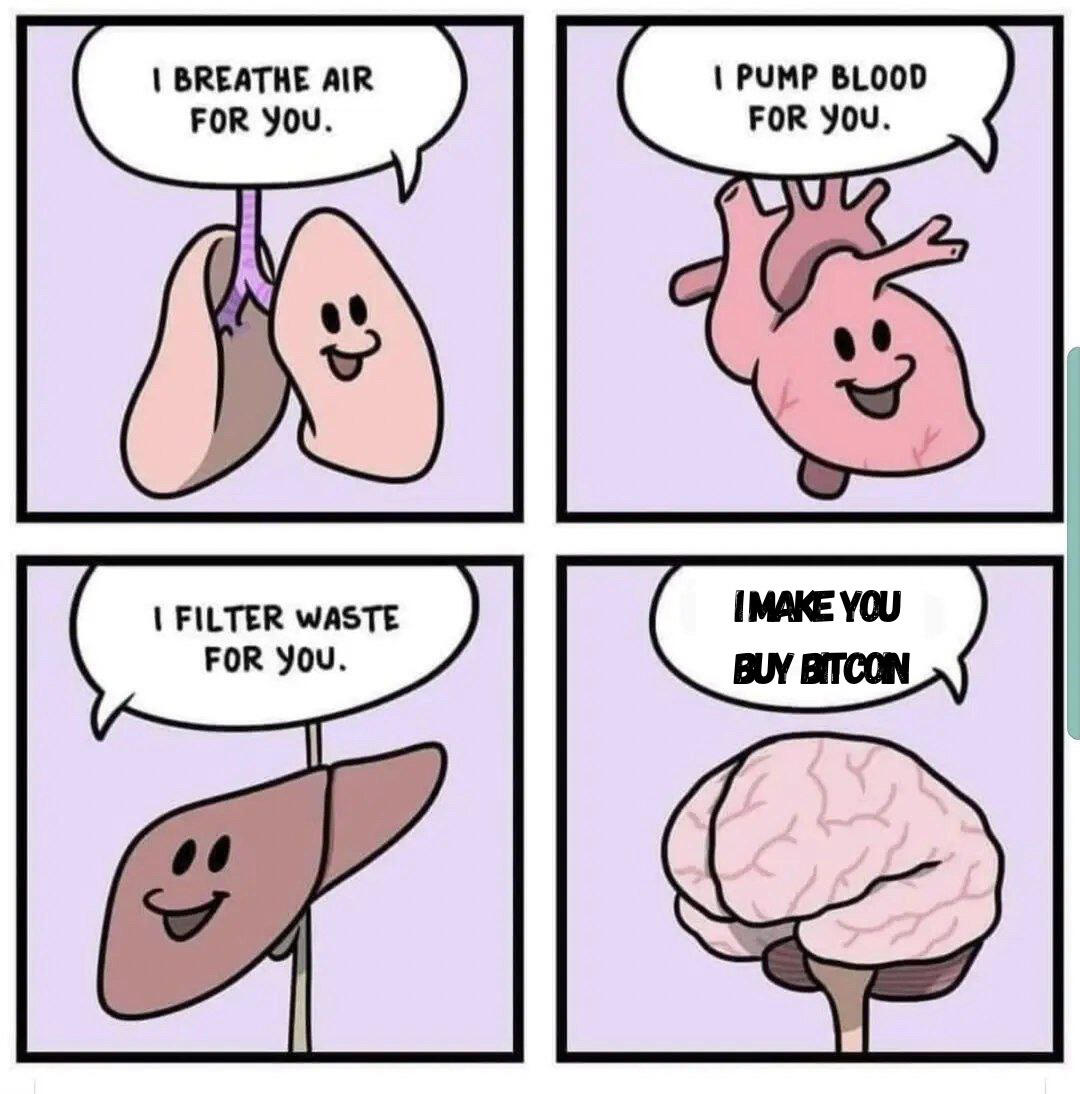

Let’s hope he keeps not wanting #Bitcoin 👀

#Nostr #Macro